Pre-IPO VCI Chemical Unlisted Shares: How Retail Investors Can Buy and Invest Safely

-

February 18, 2026 3:23 AM PST

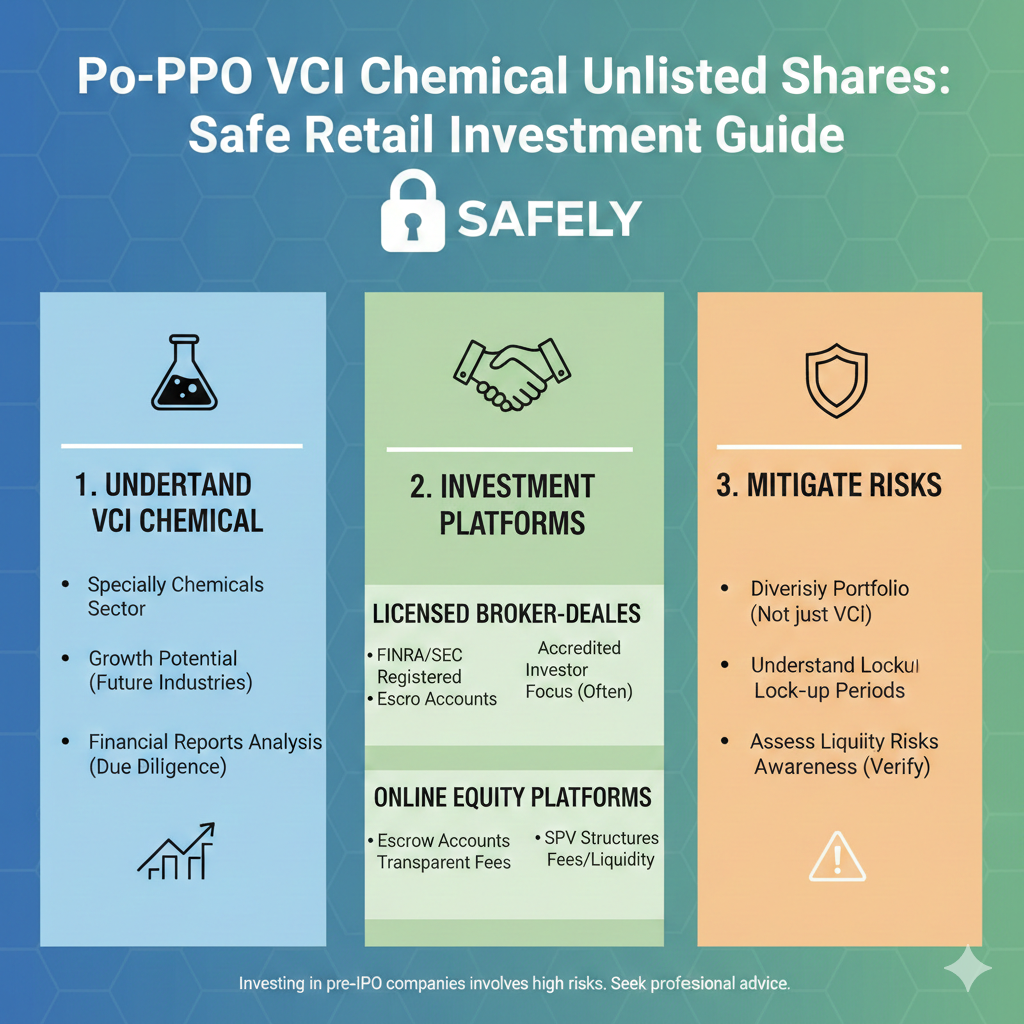

Investing in pre-IPO unlisted shares has become an increasingly popular strategy among Indian retail investors who want early exposure to high-growth companies. One such emerging name discussed in investor forums is VCI Chemical Industries Pvt Ltd, a company operating in India’s expanding specialty chemicals sector.

How to Buy Unlisted Shares of Pre-IPO Companies?

Unlisted shares are equity shares of companies that are not listed on stock exchanges like NSE or BSE. These shares are usually bought before an IPO, offering investors a chance to enter early at relatively lower valuations.

Retail investors can buy unlisted shares through:

· Private market dealers

· Unlisted share platforms

· Wealth managers and brokers

· Alternative investment funds (AIFs)

PMS (Portfolio Management Services)

However, due diligence and patience are critical, as exits are not as easy as listed stocks.

What are Unlisted Shares?

Unlisted shares are securities of companies that do not trade on public stock exchanges. These companies may be:

· Early-stage startups

· Well-established private companies

Pre-IPO firms planning to list in the future

Unlisted share prices are decided by demand, financial performance, growth prospects, and expected IPO valuation, not daily market trading.

Types of Unlisted Instruments

Apart from equity shares, several other unlisted instruments exist in India. Understanding them helps investors choose the right asset class.

Corporate Bonds

Corporate bonds are debt instruments issued by private companies to raise capital. These offer:

· Fixed interest income

· Lower risk than equity

Limited upside compared to shares

They are suitable for conservative investors seeking predictable returns.

Government Securities

Government securities include treasury bills and government bonds. While they are considered very safe, they:

· Offer lower returns

· Are less relevant for high-growth investors

Rarely provide pre-IPO-style upside

These instruments focus more on capital preservation than growth.

Swaps and Other Derivative Instruments

Swaps and derivatives are sophisticated financial contracts mostly used by institutions. They:

· Requires high capital and expertise

· Carry a higher risk

Are unsuitable for most retail investors

Retail investors focusing on unlisted shares usually avoid these instruments.

Investing in Unlisted Indian Shares

Investing in unlisted shares in India requires:

· A demat account

· PAN and KYC compliance

Understanding of valuation and exit timelines

Companies like VCI Chemical Industries attract interest because of India’s strong demand for specialty chemicals across pharmaceuticals, agriculture, and industrial manufacturing. Investors typically enter with a 3–7-year investment horizon, expecting value creation through IPOs, acquisitions, or secondary sales.

If you're planning to buy unlisted shares, here's a quick overview of the different ways through which you can purchase them

1. Unlisted Share Dealers – Buy directly from market intermediaries who arrange share transfers.

2. Online Unlisted Platforms – Provide price discovery and escrow-based transactions.

3. PMS & Wealth Advisors – Suitable for high-net-worth individuals.

4. Employee Share Sales – Employees of private companies sometimes sell ESOP shares.

5. AIF Funds – Indirect exposure through professionally managed funds.

Each method differs in minimum investment, risk, and liquidity.

Invest in PMS and AIF Schemes with Exposure to Unlisted Companies

For investors who prefer professional management, PMS and AIF schemes offer indirect exposure to unlisted shares. Benefits include:

· Expert due diligence

· Diversification across companies

Reduced operational complexity

However, these schemes usually require higher minimum investments and charge management fees.

Risks of Investing in Unlisted Companies

While returns can be attractive, unlisted shares carry significant risks that must be discussed openly in investor forums.

Liquidity Concerns

Unlisted shares cannot be sold instantly. Exits depend on:

· IPO launches

· Strategic buyers

· Secondary market demand

· Liquidity can take years.

Inaccurate Pricing

Unlisted share prices are not exchange-regulated. Pricing may:

· Vary across dealers

· Change suddenly

· Be influenced by limited information

Investors must cross-check valuations carefully.

Lacks Transparency

Private companies are not required to disclose information like listed companies. This can lead to:

· Limited financial data

· Delayed updates

· Higher uncertainty

· Increased Risk

Business risks, regulatory issues, and sector slowdowns can significantly affect unlisted companies. Since exits are delayed, losses may remain unrealized for long periods.

Minimum Regulation

Unlisted share trading operates in a less regulated environment, increasing the importance of:

· Trusted intermediaries

· Proper documentation

· Compliance checks

Final Thoughts:

Pre-IPO investments, such as VCI Chemical Industries' unlisted shares, can offer long-term wealth creation if chosen carefully. However, they are not suitable for short-term traders. Retail investors should invest only a portion of their portfolio, verify sellers, and stay updated on company fundamentals.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered as financial, investment, legal, or tax advice. Investments in unlisted and pre-IPO shares, including shares of private companies, involve high risk, limited liquidity, and may not be suitable for all investors. Unlisted share prices are not regulated by stock exchanges and may vary based on market demand, company performance, and other factors.

Investors are advised to conduct their own independent research, verify all information from reliable sources, and consult with a SEBI-registered financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses, damages, or consequences arising from the use of the information provided. Past performance is not indicative of future results.