What's Propelling the Global Superfoods Market's Accelerating Growth?

-

April 15, 2025 11:46 PM PDT

Why Is the Global Superfoods Market Thriving?

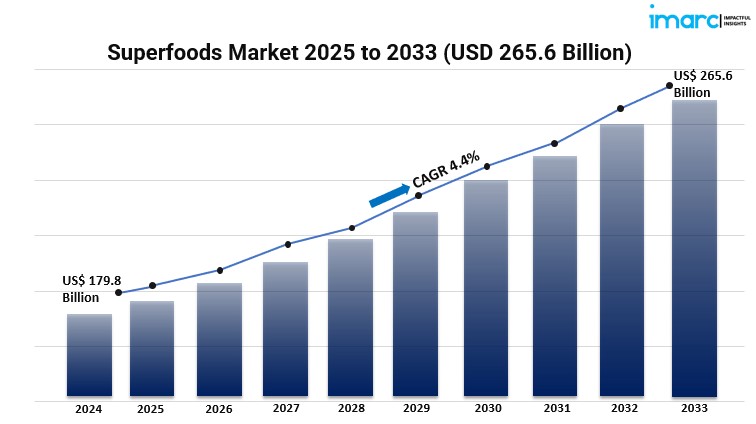

The global superfoods market size reached USD 179.8 billion in 2024 and is projected to grow to USD 265.6 billion by 2033, expanding at a CAGR of 4.4% during 2025-2033. This growth is fueled by rising health consciousness, increasing demand for nutrient-dense foods, and the growing prevalence of lifestyle-related diseases. Superfoods, rich in antioxidants, vitamins, and minerals, are gaining popularity for their ability to enhance immunity, manage chronic conditions, and promote overall wellness. North America dominates the market, accounting for 39.8% of global revenue, driven by robust consumer awareness and advanced retail distribution networks.Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Superfoods Market Key Takeaways

✔ The superfoods market was valued at USD 179.8 billion in 2024 and is projected to reach USD 265.6 billion by 2033, growing at a CAGR of 4.4%.

✔ North America leads with 39.8% market share, driven by high disposable incomes and health-conscious consumers.

✔ Fruits dominate the product segment (29.6% share), prized for their antioxidant properties and versatility.

✔ Beverages hold the largest application share (38.7%), favored for convenience and functional benefits like immunity support.

✔ Supermarkets/hypermarkets account for 49.7% of sales, offering wide product ranges and competitive pricing.

✔ Asia-Pacific is the fastest-growing region, with India’s market expanding at 8.7% CAGR due to urbanization and digital influence.

✔ Plant-based diets and sustainability trends are reshaping product innovation and consumer preferences.What Are the Key Drivers of Superfoods Market Growth?

Rising Health Consciousness and Preventive Healthcare

More and more people are turning to superfoods to tackle health issues like weight gain and diabetes, which are responsible for 71% of deaths worldwide. A study from 2024 found that diets high in superfoods, such as blueberries and kale, can lower heart disease risk by 20%. Governments are encouraging the consumption of nutrient-rich foods through programs like the U.S. MyPlate and India’s "Eat Right" initiative, boosting demand. The preventive healthcare industry, valued at USD 150 million in India, plays a vital role in growth.

Expansion of Plant-Based and Sustainable Diets

The surge in vegan lifestyles and environmental concerns is increasing the interest in plant-based superfoods like quinoa and chia. The plant-based food market in the U.S. grew by 27% from 2020 to 2023, reaching USD 7 billion. In India, black rice and millets are becoming popular as eco-friendly options, supported by government farming programs. Brands are creating products like dairy-free moringa almond milk and vegan protein powders for this audience.

Technological Advancements and E-Commerce Penetration

Online shopping is making it easier to find superfoods, with India’s online grocery market expected to grow at 27% each year. Social media influencers and digital marketing increase awareness, especially among younger folks. New products like turmeric latte mixes and ready-to-eat superfood salads cater to the needs of city dwellers looking for convenience.Market Segmentation

Breakup by Product Type:- Fruits – Largest segment (29.6% share), including berries and pomegranates for antioxidants and fiber.

- Vegetables – Kale and spinach, valued for vitamins and anti-inflammatory properties.

- Grains and Seeds – Quinoa and chia seeds, rich in protein and omega-3s.

- Herbs and Roots – Turmeric and ashwagandha, used in immunity-boosting supplements.

- Meat – Salmon and lean meats, popular for high-protein diets.

- Others – Includes niche products like algae-based superfoods.

Breakup by Application:

- Bakery and Confectionery – Superfood-infused cookies and granola bars.

- Beverages – Dominates with 38.7% share, including green juices and acai smoothies.

- Supplements – Capsules and powders for targeted nutrition.

- Convenience/Ready-to-Eat Foods – Fastest-growing segment, with India’s RTE market expanding at 45%.

- Others – Includes cosmetics and pet food.

Breakup by Distribution Channel:

- Supermarkets/Hypermarkets – Leading channel (49.7% share) due to product variety and discounts.

- Convenience Stores – Focus on on-the-go snacks and single-serve items.

- Specialty Stores – Cater to health enthusiasts with curated selections.

- Online Sales – Growing via subscriptions and D2C models.

- Others – Includes pharmacies and independent grocers.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Which Region Dominates the Superfoods Market?

North America is the biggest player, holding a 39.8% market share. The U.S. leads this with 75.6% of demand coming from health-conscious consumers and easy access in stores. Europe follows, with Germany and the U.K. driving growth through organic certifications and plant-based fads.What Are the Latest Innovations in the Superfoods Industry?

Recent innovations highlight Gaia Herbs’ postbiotic-fermented superfoods for digestive health and Creative Nature’s allergen-free BBQ snacks for airlines. Brands are mixing traditional elements like turmeric with modern versions such as millet pasta. Meanwhile, blockchain tech is ensuring transparency in the supply chain for organic goods.Who Are the Key Players in the Superfoods Market?

Archer-Daniels-Midland Company, Creative Nature Ltd., Del Monte Pacific Ltd., Healthy Truth, Nature's Superfoods LLP, Navitas LLC, Nutrisure Limited (Supernutrients), Rhythm Superfoods, LLC, Suncore Foods Inc, Sunfood Corporation, Superlife Co. Pte. Ltd., etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.