What Does the Latest Forecast Indicate for the Future of the Salmon Market?

-

April 15, 2025 11:37 PM PDT

What Is Driving the Global Salmon Market Growth?

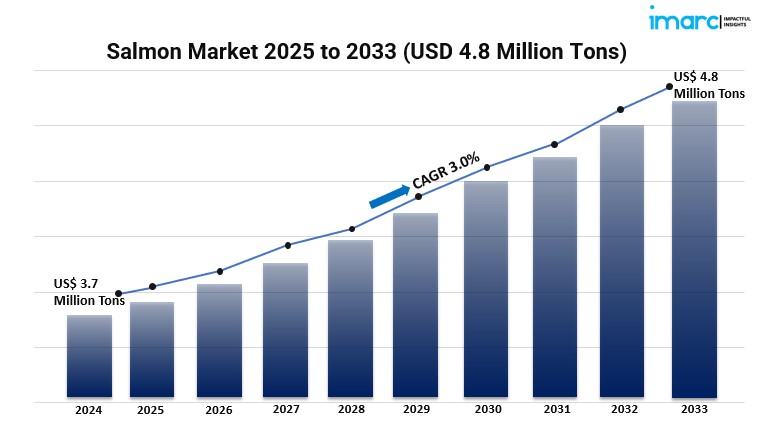

The global salmon market is experiencing robust growth, fueled by increasing health consciousness, rising disposable incomes, and a growing demand for protein-rich diets. In 2024, the market reached 3.7 million tons and is projected to expand to 4.8 million tons by 2033, reflecting a compound annual growth rate (CAGR) of 3.0% during 2025–2033. Key factors propelling this growth include the expansion of aquaculture, technological advancements, and supportive government policies promoting sustainable seafood production.​

Study Assumption Years- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033​

Global Salmon Market Key Takeaways

- Market Size and Growth: The global salmon market was valued at 3.7 million tons in 2024 and is expected to reach 4.8 million tons by 2033, growing at a CAGR of 3.0% during 2025–2033.

- Regional Dominance: The European Union leads in consumption, holding over 46.3% market share in 2024.

- Product Segmentation: Farmed salmon dominates the market, with Atlantic species being the most prevalent.

- End Product Preference: Frozen salmon is the most popular end product, followed by fresh and canned variants.

- Distribution Channels: The foodservice sector accounts for the majority of global sales, indicating strong demand from restaurants and catering services.

- Technological Advancements: Investments in aquaculture technology and sustainable feed formulations are enhancing production efficiency and environmental sustainability.

- Government Initiatives: Policies like India's Pradhan Mantri Matsya Sampada Yojana (PMMSY) are fostering investments in modern aquaculture techniques and promoting responsible salmon farming.​

What Are the Major Growth Factors Fueling the Salmon Market?

Rising Health Consciousness and Nutritional Awareness

People are putting more focus on health and well-being, which is raising the demand for healthy foods like salmon. Packed with omega-3 fats, high-quality protein, and necessary vitamins, salmon offers many health perks, like better heart health and improved brain activity. This rising awareness is boosting consumption across various age groups, especially among those who are health-oriented and want balanced diets.​

Technological Innovations in Aquaculture

New technology in fish farming is greatly affecting how salmon is raised. Tools like automated feeders, fish that can resist diseases, and eco-friendly feed are boosting production and lowering harm to the planet. These advancements are making processes more effective while ensuring salmon farming is of high quality and meets consumer expectations for responsible seafood.​

Supportive Government Policies and Sustainable Practices

Governments around the globe are encouraging sustainable fishing and smart fish farming. For example, India's PMMSY initiative aims to increase fish production and exports while pushing for modern farming techniques. These actions help create a positive setting for the salmon market to grow, ensuring it meets future demands.Market Segmentation

Breakup by Type- Farmed: Dominates the market due to controlled production environments and consistent supply.

- Wild Captured: Preferred for its natural habitat origin, appealing to consumers seeking traditional sourcing.​

Breakup by Species

- Atlantic: Most prevalent species, favored for its taste and texture.

- Pink: Known for its mild flavor and affordability.

- Chum/Dog: Valued for its firm texture and suitability for smoking.

- Coho: Appreciated for its delicate flavor and high oil content.

- Sockeye: Recognized for its rich flavor and deep red flesh.

- Others: Includes lesser-known species catering to niche markets.​

Breakup by End Product Type

- Frozen: Most popular due to extended shelf life and convenience.

- Fresh: Preferred for immediate consumption and premium quality.

- Canned: Offers long shelf life and ease of storage.

- Others: Includes smoked, dried, and other value-added products.​

Breakup by Distribution Channel

- Foodservice: Accounts for the majority of sales, driven by restaurants and catering services.

- Retail: Includes supermarkets, hypermarkets, and specialty stores catering to individual consumers.​

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Which Region Leads the Global Salmon Market?

The European Union is leading the global salmon market, responsible for over 46.3% of consumption in 2024. This success comes from the region's solid fish farming structure, high demand for seafood, and favorable laws that promote eco-friendly fishing.​

What Are the Latest Trends and Developments in the Salmon Market?

Current trends in the salmon market include new products like salmon jerky, oil, lox, and spreads, which cater to various tastes. The rise of restaurants and fast-food spots is also driving up demand. There’s big growth in fish farming and seafood production, opening up new chances for expanding the market.​

Who Are the Key Players in the Global Salmon Market?Cermaq Group, Lerøy Seafood Group ASA, Mowi ASA, and SalMar ASA, etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.